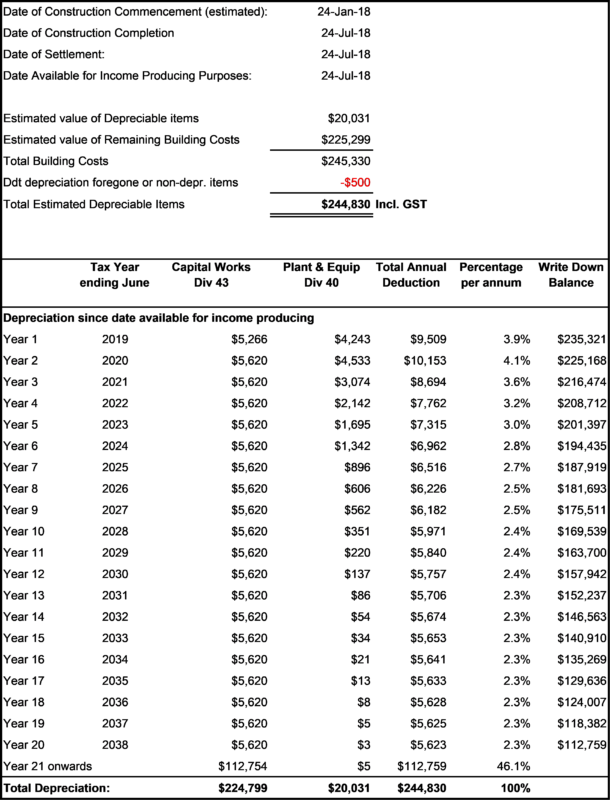

Below is a table that shows how much depreciation from this newly built terrace house can be claimed back over the first 20 years. The house has a floor area of 180 m2 and a build contract price just over $245,000.00. The land cost does not form part of the deductions available. As you can see the total annual deductions by using the diminishing value is around $10,000 per year for the first 2 years. With new builds you can include the Plant and Equipment ( Division 40 ) as opposed to second hand homes which you can not include anymore. It is always better to buy brand new over second hand.